You want your subscription business to grow, and the most obvious solution is to go out and get more customers. But it’s easy to be dazzled by the importance of acquisition for too long – as your business matures the focus must switch to retention. Here’s why.

The customer is always right

The fundamental difference between acquisition and retention is that the latter is supported by data. And it’s your data. You know your customers well because you have a relationship with them and – most of the time at least – you can tap into lots of great data about how, when and why they use your products and services. By contrast, anything you do to attract new customers is something of a leap of faith. You don’t know them, so how can you truly know what they want? Acquiring customers costs time effort and increasing amounts of money. The time it takes to payback the cost of winning a new customer is significant in a subscription business. Getting this wrong is a serious growth blocker.

Using your knowledge of existing customers enables you to grow and develop your relationship with them: to find ways to provide more value, extend your reach within their organization to other departments, to add features – and ultimately expand revenue as you expand the value for your customer. For an established subscription business, you should be able to find more growth in an effective retention strategy rather than focusing on acquisition.

The truth is that a balanced strategy incorporates both acquisition and retention activities. But as the more flamboyant of the two, acquisition often leaves its sibling in the shade. With knowledge of your most successful segments of existing customers – those who are growing fast with you – you should model your acquisition lists to bring the ideal customer into your orbit.

The fundamental of recurring revenues is the renewal and the resulting compound growth – therefore retention should be the number one priority for subscription businesses. We think it’s time to place retention directly in the spotlight – and the customer at the heart of thinking to unlock growth.

What can we measure?

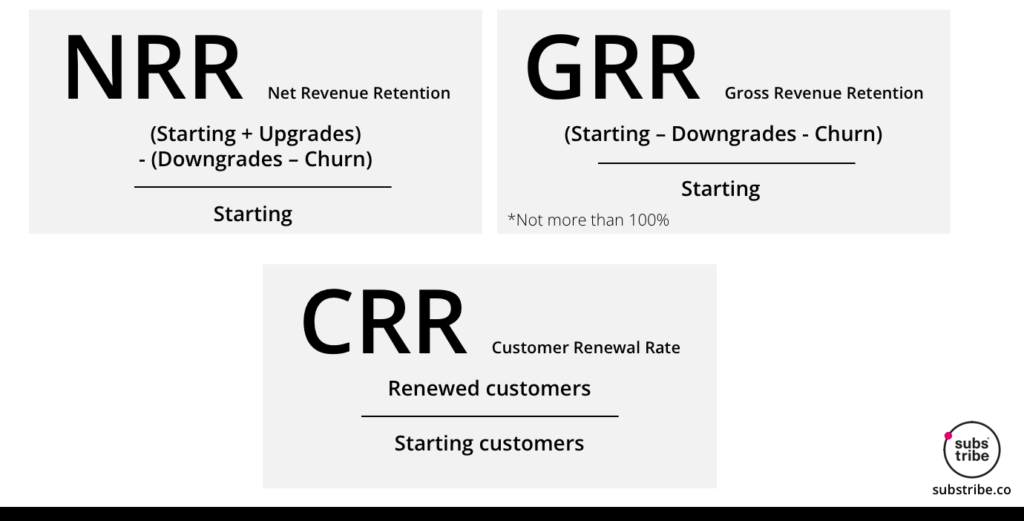

The first key measurement of success is Net Revenue Retention (NRR) – in other words, your company is growing revenue from your existing customers. Simply put, if you reach 120% NRR for 5 years, you will more than double the size of your revenues with no new business. For example, a starting position of £10 million grows to £24.8m.

If your revenue expansion from existing customers isn’t more than 100% then you are either establishing your place in the market, or if you have an established subscription business then something is going wrong.

NRR can be a blunt tool on its own. To use the sharp end of the NRR tool, segment your customers by age (how long they have been with you) package (which tier / service), market, user group, geography, and more. This paints the picture of where you are getting most growth. But on its own, NRR doesn’t give you the full picture. Revenue expansion may be masking the loss of customer accounts creating problems for the long term health of your business.

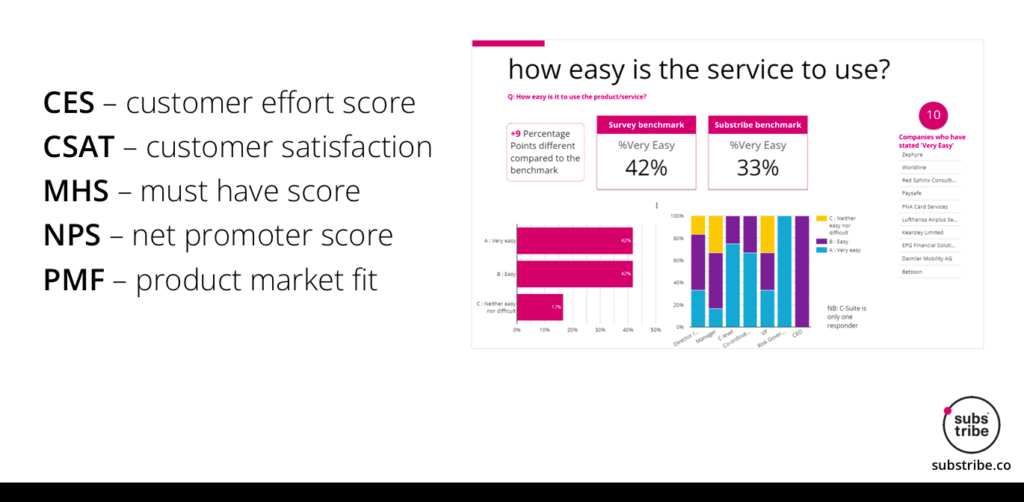

To dig deeper we need to measure both engagement and sentiment, with insights gathered from direct usage data or from surveys and conversations with customers. Retention will suffer if your subscribers are not using your product, or if your subscribers are using your product but are not finding it useful.

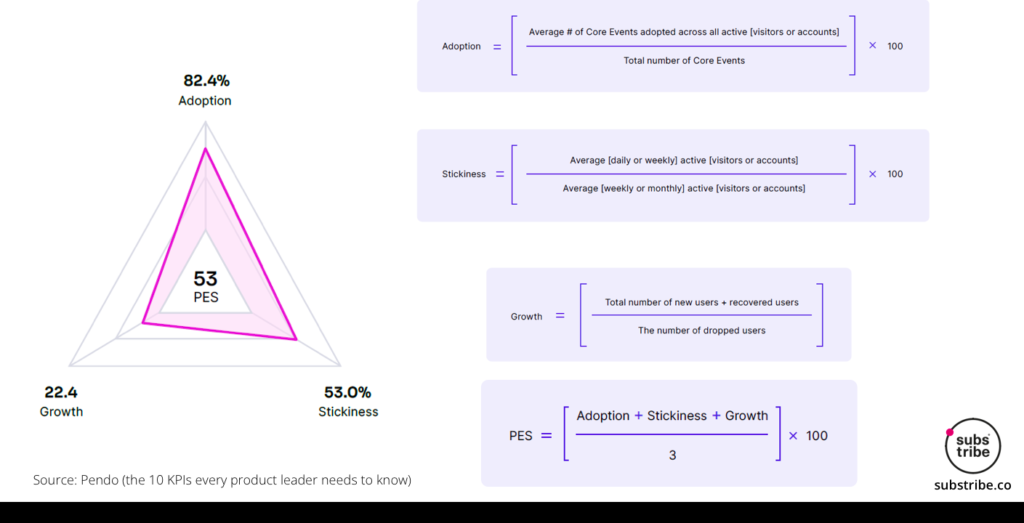

And so this brings us to one of the biggest challenges: linking them all together into a meaningful composite measurement. We need a way of measuring not just whether revenues are going in the right direction: we also need to know whether customers are using and benefitting from our product.

Is product engagement the answer?

We have been interested to see a nascent product engagement score (PES), metric providing a singular view into how users are interacting with your product. The first stage is to define ‘core events’, i.e. the differentiating features within your product or service. You then measure adoption (the number of core events adopted across all users), stickiness (how many of those users return on a regular basis) and growth (how much your user base is growing). PES is the brainchild of software usage analyst Pendo and the resultant spider map (shown below) is akin to a steering wheel that you can use to chart a course towards understanding how your customer is making use of the valuable parts of your service.

Who are you measuring?

There are further nuances to take into account – for example, not all customers are equal. The most obvious difference is between economic buyers and end users. They are all customers, but economic buyers, such as C-suite or procurement teams, do not have direct knowledge of the product. Whereas end users may give positive scores because of the product’s ease of use and the difference it makes to their daily lives, the economic buyers need proof. Not only that, they need to see actionable value. This requires alignment between what you provide and what your customers are trying to achieve.

To understand their goals and seek to align with them. It’s not enough to say it makes your users more efficient. Give them a specific scenario whereby your product or service makes them more likely to achieve a specific goal and you start to speak their language. Taking this back to the point made about acquisition strategy, the sales team should be getting this alignment right from the get go, and the retention and expansion team should be equally expert at aligning to customer performance at an individual, team and company level.

Engaged, but not married for life

High engagement scores mean high potential for retention, right? Not always. Substribe community members point out the pitfalls of taking engagement metrics at face value. Some subscriptions carry a high prestige value; this means that engagement levels may be non-existent, but some traditional customers wouldn’t dream of stopping the subscription. On the other hand, some products are used intensively, but alongside competitive products. As soon as it is noticed that the competitor adds more value, they may drop the subscription like a stone.

This is why it is so important to measure sentiment, engagement and financials in a joined up way. In the scenario above, you can end up with highly engaged customers who churn and completely unengaged customers who don’t churn. How do you make sense of that? A symptom of this is inaccurate forecasting – how confident are you about your revenue and customer retention forecasts?

Good habits and bad habits

Equal care needs to be taken when looking at frequency of use. It is almost certainly a good thing for any subscription-based product to become a habitual part of customers’ daily lives, but as in life, there are good and bad habits.

A daily digest email, for example, may attract very high click-through and engagement rates and be noticed by thousands of users every morning. But the real value may be in the deep analysis and insight in the underlying articles and information, and the customers may rarely access this. If the customers are not getting real value, it may lead to churn – where you’re perceived to be nice to have (or even noise), rather than must have.

Keep the customer in the centre

One of the main reasons for focusing on retention is that it puts the customer at the centre of your thoughts. You focus on what they want, where they find value, and how you can position your product as the best way of accessing that value. This learning exercise will therefore equip you to be more effective in your acquisition activities. You will have a much better idea of what new customers are likely to want – and can thus not only create better products, but also create new business campaigns that say what people want to hear.

While it’s great to be more than doubling your revenues from existing customers over time, of course you should be acquiring new customers. But the the way to put the after burners on your subscription business to scale is by getting your unique retention metrics joined up to your acquisition activities. This is acquisition for customer lifetime value.

If you want to know more about how the Substribe community can help you achieve better retention, please get in touch with Danielle Harvey.

Leave a Reply