Expansion revenue is where it’s at. But are you match fit?

The cost of acquiring customers is increasing. In today’s economic climate, embracing smaller renewals is better than full churn. But, that means expansion revenue needs to make up the short fall. Expansion revenue is extra money generated from existing customers

It isn’t as simple as pulling the lever market ‘expansion.’ The fundamentals in b2b subscriptions are – right customer, frequent problem, clarity on how to solve it. If the fundamentals are not in place, you may boost revenues from existing customers today, but the customers will leave tomorrow.

The ratio of expansion revenues to total annual recurring revenue for our community is 18% – an optimal ratio is 30%”

Substribe Subsclub december 2022

What lever should you pull next and why?

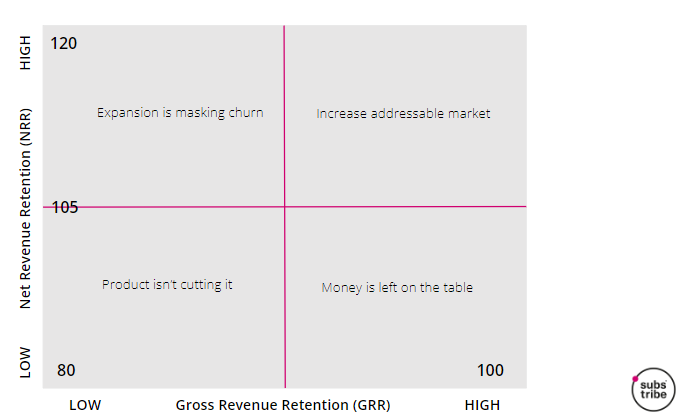

Here’s how we figure out what the situation is for our clients – using a simple 2×2 grid. The grid is about recurring revenues from existing customers. The horizontal axis records how much revenue you keep. The vertical is how much additional revenue you make.

The priority for an established subscription business is to get in – and stay in – the top right of the 2×2. In other words, keeping and growing revenues from existing customers. A mix of high net and gross revenue retention.

About the 2×2

Gross Revenue Retention (GRR) is a measure of how much money you keep from existing customers without expansion.

Gross revenue retention is the life force of your subscription business. Looking along the horizontal line, plot your gross revenue retention.

Notice GRR starts at 80% and goes up to, but not more than, 100%. Below 80% and you don’t have enough life force to go on….you need the intensive care unit.

GRR can’t be more than 100% because this is a measure that takes away from your starting revenue. It doesn’t include price increases and upgrades. It’s the unvarnished picture of your subscription health.

Net revenue retention (NRR) is a measure of how much extra money you are able to make from your existing customers.

You take your starting revenue. Add your price increases. Your upgrades. As long as it’s recurring revenue. Then you take away the stuff that shrinks your growth. Discounting. Downgrades. Active cancelled customers.

NRR is the turbo boost button for your subscription business. Aim for the top right of the 2×2 – if you are there, you’re in an endurance race to stay there. Depending on where you are on the grid, you’ll need to pull the right lever to get to the top right. High NRR with low GRR is a bad sign. You could be “crushing targets” but bleeding out.

This is why looking at both NRR and GRR is important.

This is a useful way to structure our thinking about subscription opportunity and risk”

Subsclub member

Figuring things out

As a starter, here’s a comment about what might be happening / what might be done in each box of the grid.

Revenue retention is a lagging indicator, but in a world of annualised subscriptions in a b2b setting, it is a proxy for value and price.

Tracking revenue retention is a useful performance measure – informing the success of tiered packages, customer lifetime value and more. It’s useful to consider alongside customer sentiment and user behaviour trackers.

If you are a b2b subscription leader, join us at our next Subsclub*

* about our community of b2b subscription leaders: their experience is in information, data, analytics, pricing. Sometimes getting into workflow. Other times, specialist content. And the bits in between. Typically it is a sales led growth approach, ultimately landing enterprise wide subscriptions. Contracts are annual or multi year. While there are differences, such as vertical and horizontal markets there is common ground. The shared DNA is a desire to create and sustain a must have service for their customers.

Leave a Reply